Investing is one of the most effective ways to grow your wealth over time. However, it’s important to understand the impact of investment fees on your returns. Even small differences in fees can add up to a significant amount over time, which can impact your ability to achieve your financial goals.

In this blog post, we’ll explore the potential cost of paying a 2% fee annually on an investment growing at 7% annually over 20 years. We’ll walk through a specific example to demonstrate the impact of fees on investment growth, and provide strategies for reducing investment fees.

The impact of investment fees is often overlooked, but can have a significant effect on your returns. Even seemingly small differences in fees can add up to thousands of dollars over time. Understanding the impact of investment fees can help you make informed decisions about where to invest your money and how to minimize fees.

The Impact of Investment Fees

Explanation of Investment Fees

Investment fees are charges that are incurred when you invest your money. These fees can be charged in various ways, such as a percentage of assets under management, a flat fee, or a fee per transaction. Investment fees can be charged by various parties, including investment managers, brokers, and financial advisors.

How Fees Impact Investment Growth Over Time

Fees can impact investment growth in two ways: they reduce the amount of money that is invested, and they reduce the returns on that investment. When you pay a fee, that money is no longer invested and is instead paid to the person or company charging the fee. This reduces the amount of money that can grow over time. Additionally, fees can reduce the returns on your investment.

The Significance of Even Small Differences in Fees

The impact of fees is often underestimated, but it’s important to understand the true cost of investing. By understanding the impact of fees, you can make informed decisions about where to invest your money and how to minimize fees. In the next section, we’ll explore a specific scenario to demonstrate the impact of fees on investment growth.

Example Scenario

Assume you invest $100,000 in an investment that grows at 7% annually over 20 years. However, you pay a 2% fee annually, which is subtracted from your investment before the growth rate is applied.

First, let’s calculate the value of the investment after 20 years without fees.

$100,000 x (1 + 7%)^20 = $386,968.67

Now, let’s calculate the value of the investment after 20 years with a 2% fee annually.

$100,000 x (1 + 5%)^20 = $265,329.14

The potential cost of paying the 2% fee annually over 20 years is the difference between the two amounts:

$386,968.67 – $265,329.14 = $121,639.53

In this scenario, paying a 2% fee annually instead of earning a 7% annual return resulted in a potential cost of $121,639.53 over 20 years. The total return is therefore:

$265,329.14 – $100,000 = $165,329.14

Therefore, the percentage of the amount paid in fees compared to the total return is:

($121,639.53 / $165,329.14) x 100% = 73.65%

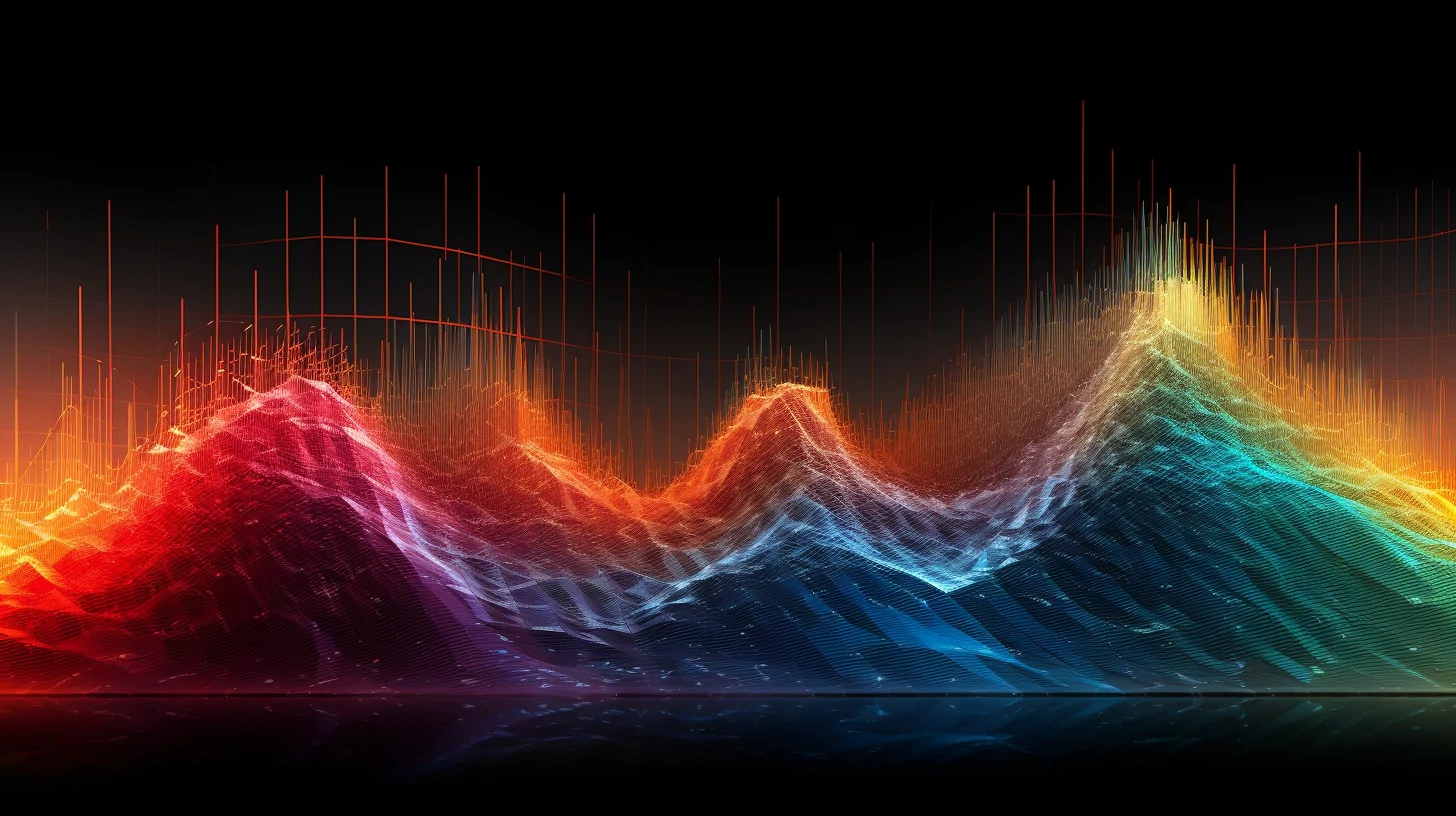

To further illustrate the impact of fees on investment growth, let’s take a look at a visual representation of the scenario.

The graph shows the growth of the investment over time with and without fees. The blue line represents the growth of the investment without fees, while the orange line represents the growth of the investment with a 2% fee annually. As you can see, the impact of fees becomes more significant over time, with the gap between the two lines growing wider.

Strategies for Reducing Investment Fees

Fortunately, there are several strategies you can use to reduce investment fees and maximize your returns.

- Comparison of fees across different investment vehicles

One strategy for reducing investment fees is to compare fees across different investment vehicles. For example, mutual funds and exchange-traded funds (ETFs) have different fee structures. Mutual funds typically charge higher fees, while ETFs tend to have lower fees. - Strategies for negotiating fees

Another strategy for reducing investment fees is to negotiate fees with your investment manager or financial advisor. While not all investment managers or financial advisors are willing to negotiate fees, some may be open to doing so, especially if you’re a long-term client or have a large investment portfolio. Be prepared to negotiate and make a case for why you believe the fees should be reduced. - The potential benefits of paying higher fees for certain investment opportunities

While it’s generally a good idea to minimize investment fees, there are certain investment opportunities where paying higher fees may be worth it. For example, some alternative investments, such as private equity or hedge funds, may have higher fees but also offer the potential for higher returns. It’s important to carefully consider the potential benefits and risks of any investment opportunity before deciding whether the higher fees are worth it.

Ultimately, the key to reducing investment fees is to be informed and proactive. By comparing fees, negotiating with investment managers or financial advisors, and carefully considering the potential benefits and risks of different investment opportunities, you can minimize fees and maximize your returns over time.

Conclusion

Investment fees are an important consideration when investing your money. Even seemingly small differences in fees can add up to a significant amount over time, impacting your ability to achieve your financial goals.

We learned that investment fees can impact investment growth by reducing the amount of money that is invested and reducing the returns on that investment.

Investing is a powerful tool for growing your wealth, but it’s important to be informed and proactive about managing investment fees. By understanding the impact of fees and implementing strategies to reduce them, you can achieve long-term investment success and achieve your financial goals.