These 8 Golden Rules are all you need for trading success!

Compounding to Wealth over 10 Years

Initial $10,000

End of Year 1: $20,000

End of Year 2: $40,000

End of Year 3: $80,000

End of Year 4: $160,000

End of Year 5: $320,000

End of Year 6: $640,000

End of Year 7: $1,280,000

End of Year 8: $2,560,000

End of Year 9: $5,120,000

End of Year 10: $10,240,000

Over 100x Your Initial $10,000

Trading is not gambling and is not about getting lucky.

Successful trading and wealth building is about consistently good risk and money management.

There are old traders and there are bold traders, but there are very few old, bold traders.

– Ed Seykota, Legendary Trader

Let that quote above sink in for a second and think about what that means.

You may be able to get lucky once or twice, but over time it will catch up to you sooner rather than later.

All it takes is one time for the market to wipe out your whole account in an unexpected move if you don’t have proper risk management.

Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

– Albert Einstein

Looking for opportunities to compound should be your goal as a trader; not trying to hit one or 2 big trades then calling it quits.

These are 2 golden trading rules that go together. Most people do the opposite here. They take their profits too quickly AND they hold on to losing trades thinking or hoping the market will turn around and they can get out of their losing trade with less of a loss.

What happens though is usually the opposite- their loss continues to get bigger and bigger and bigger… either until their entire account is liquidated, or they are forced to exit their trade at a much bigger loss than they could have if they didn’t continue to let it get larger and larger.

We call this smoking “hopium” – they get lost in the hope that the future may turn their luck around, when the reality is the majority of the time it doesn’t.

It may happen once or twice, but it would be a fools game to hope it will; all it takes is one time for it not to go your way… and when it doesn’t, your entire trading account will be wiped out.

Not following these 2 golden trading rules cause the majority of people trading to lose their entire trading account or never grow it into something meaningful.

The reason most traders don’t follow these 2 simple golden trading rules is because when it comes to riding winners and cutting losers quick, most people let their emotions get in the way.

Its easy to say that you won’t do it, but once you are in the middle of a trade with real life money that actually means something, this is where emotions will really creep in.

Most people get into some profits and as soon as they do, they take their small profits.

Maybe they are scared of losing what they have so they take their small profits.

Maybe they are excited they actually made something, so they take their small profits.

Whatever it is, they never exercise patience and allow their money to grow.

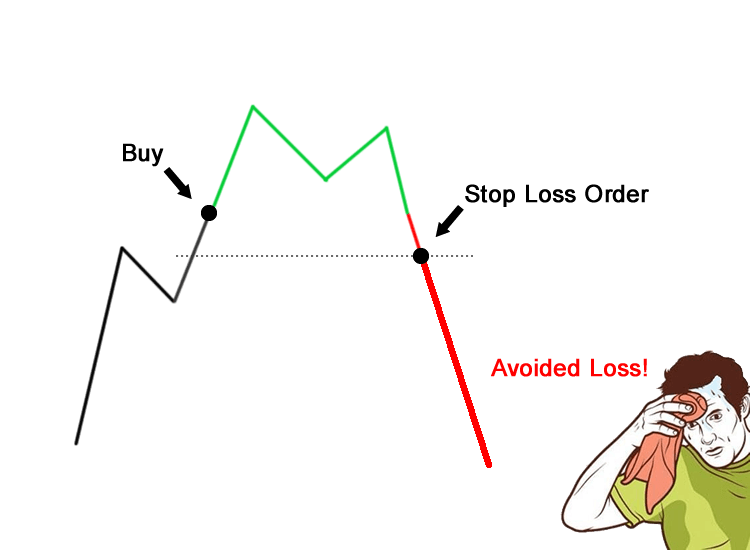

Managing risk really comes down to 2 parts:

Using Stop Losses and Using Correct Position Sizing.

A stop loss means that if you are in a trade and you lose a set amount, you exit the trade immediately.

For example, this can be a dollar amount like $500, or 1% of your account.

What is the right stop loss for you to use?

It depends on 2 things- how much you can risk losing and feel ok with, and what the expectancy of your trading system is.

If you don’t know what the expectancy of your trading system is, you should not be trading.

You can find out the expectancy by using a TradingView strategy and seeing its performance. We will go over this at the end of this article.

Position sizing is quite possibly the most overlooked factor in trading.

You never really hear anyone talk about it. What position sizing means is how much of your account should you use to enter a trade?

Position sizing also depends on your trading system.

If you have a strategy that does well with a 5% stop loss, but you only feel comfortable losing 1% of your account in any trade, this means you should only enter with 20% of your account. That way if your 5% stop loss gets hit, you only lost 1% of your trading account.

Keep in mind though that using less of your account balance means that when winning trades come along, you also make less money since you used less money to begin with.

So successful trading is all about finding an optimal balance that works for you.

There is no one that can answer that question but you. Some people are willing to take more risk, some people less risk.

The idea in successful trading is to stay alive until your big trades come. Proper Stop losses and Position Sizing allow you to do just that.

How do you know if the risk is right? You make a lot of money and you sleep at night!

– Ed Seykota, Legendary Trader

What a simple quote above. You make an amount of money that is actually meaningful to you and the amount you risk to do it leaves you unworried, not thinking about it, and not interfering with your trading system.

This is the epitome of Zen Trading.

Trading Rule 5: Use Stop Losses

To be successful in trading, using stop losses is a must. What we are about to say is so important we will put it all in caps.

IT IS MORE IMPORTANT TO NOT LOSE MONEY THAN IT IS TO MAKE MONEY.

– Warren Buffet, Legendary Investor

Let that sink in for a moment.

Your trading account is your capital engine. It takes money to make money in trading.

If you lose your money, you can’t make money.

If you let your account dwindle down too much you also lose your compounding power. So capital preservation must always be number one.

A successful trader must have the mindset that he is a risk manager, not a profits manager. If you manage your risk properly, the profits will take care of themselves.

The way to make sure you don’t lose your account is by using judicious stop losses and proper position sizing.

If you treat trading like a get rich quick scheme, you will lose all your money.

You have to have a long term mindset to be ultra successful as a trader.

Being a trader is being a wise money manager.

This part sounds easy.

But even with the best systems in place, if a trader’s emotions are not in check, his emotions will cause him to override his system.

What happens when you thought you have a really good trading system but you actually lose a few trades in a row? Do you start doubting your system? Start trying to tweak it?

What happens if the exchange you are trading on goes down for an hour during peak times and you can’t access your trades?

What happens if an order didn’t get executed properly?

How does taking a loss make you feel? Should you win every time?

How does taking a win make you feel? That you’ll win next time?

What happens if all of sudden it seems like you can’t lose?

What if it seems like everything just seems to keep going up in price? Or down?

There are countless such situations, and all will test your emotions as you encounter and experience them in real time.

This leads us to the next Golden Rule of Trading, “Stick to your trading system”.

Trading Rule 7: Stick to Your Trading System

It is easy for emotions such as fear, doubt, anxiety, hope, uncertainty, and greed to step in.

Every trader must learn to accept each of these emotions and befriend them.

Each of these emotions has a positive intention and it is up to the trader to discover what they may be.

For example, uncertainty may have the positive intention of making a trader want to use prudent risk management, so any uncertainty is managed.

A trader must know himself and study his emotions that his trading system will bring him. Only then will a trader be able to stick to his system.

These situations mentioned above will happen and you must know ahead of time how you will react or how to manage them.

For example, if you lose several trades in a row, it doesn’t necessarily mean you have a bad trading system, or that you have to throw it away or redo it.

It could just be a random distribution of poor trades.

If you study your trading system thoroughly you can know this possibility ahead of time and be prepared if it happens in real time.

If the exchange you are trading on gets overloaded for a few hours due to excessive traffic and you can’t access it, are your orders already in?

If you win several times in a row and the market seems to be unstoppable and you can’t seem to lose a trade do you all of a sudden start using 2 or 3 times more money to trade?

There are countless situations that will come up and to be successful long-term in trading you must have a system and stick to it.

No matter what random events happen, you stick to the system.

Having the confidence that you actually have a good system to begin with is key, and the way you create that confidence is in knowing and understanding how your strategy works, and how it might act in different situations.

These are all things you can backtest by using a TradingView strategy script from this site and running different tests and analyzing the performance.

Only those that want to be ultra successful will do this.

Have you ever turned on the TV or seen on the internet news about what’s happening, may happen or what “will” happen?

Following this and making trading decisions based on it is also a surefire way to lose your entire account.

By the time something has made news, the effects of it are already priced into the stock or asset you are looking at. Many people knew about it before you got wind of it in the news.

Don’t do what the majority of other traders do and listen to the news for trading.

Others see a news article somewhere and believe it to be true. News articles by their very nature are designed to inspire emotions of fear or greed.

For a trader to read such an article and then act on it by making a trading decision based on that news will trade based on emotions, and we already covered that trading emotionally will end in certain ruin.

Turn off the news, don’t pay attention to it, and don’t pay attention to what other traders are doing or saying.

Stick to your system. Know it, understand it, put the work in, believe in it and pave your own path to success.

Trading Rule 9: Have a System that Uses These 8 Golden Rules Together

We just covered the 8 Golden Rules of trading. These rules all come down to having a strategy system and trading from it.

On this site we have developed powerful tools you can use with TradingView that we also use ourselves to create consistently profitable, low risk strategies.

You can literally have a strategy up in less than 60 seconds.

How much time you want to spend fine tuning it is up to you. Sometimes less is more.

But with such tools as you find on this site to create your own trading strategies, you can easily develop a system that will make you feel really comfortable, at ease, happy, successful and profitable.

We also provide education on how to use each strategy.

Either way this site gives you everything you need to be a legendary trader.

The only way to long term, consistent trading success is to have custom strategies with trading rules that have a real edge in the markets, can compound money, and can keep your risk and losses minimal.

Whether you are a trend following trader, mean reversion trader, day trader, swing trader, or long term value investor, you need strategies that can get you the best entries and get you the best exits.

Your risk to reward must be kept small. You also need to trade strategies that no one else is trading.

Here at Zen Trading Strategies we give you the tools and trading rules to make custom Tradingview strategies (in less than 60 seconds) for any market that will appear right on your chart visually.

No need for coding or programming on your part- we’ve done that for you already.

These are the same tools we use for our own strategies. The only difference is that anyone who uses these tools will create their own custom settings and trading rules on any tradable asset in the market.

There are unlimited possibilities and flexibility to make different strategies and trading rules with the tools we provide.

With custom Tradingview strategies you can backtest any idea you have and see how valid your trading idea is.

You will be able to see how much profit, how much loss, what your win and lose rates are, where and how your strategy won or lost, and so much more.

If you like your strategy and its trading rules, you can trade it manually.

Or we also have developed Tradingview indicators for each strategy that allow you to create automated alerts on your entries, take profits, automate exits and stop losses, and we also even have ways to get those orders sent instantly and seamlessly to almost any exchange you want of yours for 100% automatic trading.

You will never have to sit in front of a computer screen to look at a chart ever again if you don’t want to.

Your trading can be 100% hands off.

Get Every Instant Buy or Sell Trading Signal on this page on Telegram as soon as they happen in real time and join the discussion.

Click Below To Get Free Access