Introduction

The financial world is in a state of constant evolution. One key component that has gained momentum over the years is trading system development. At its core, this discipline focuses on designing, building, and testing robust trading models to make profitable trades. Traders around the globe recognize the potential of these powerful tools and employ them regularly. The secret sauce? A combination of strategy, data analysis, and a touch of intuition.

Having a well-built trading model is the equivalent of possessing a map in unknown terrain. You have direction. Moreover, you’re not simply guessing. Your decisions are data-backed, thus more likely to be accurate. In short, building and testing profitable trading models can transform the way you approach trading.

Building a Profitable Trading Model

Every trading model begins with an idea, a hunch about the market you want to test. This hunch develops into a hypothesis, then a strategy. Ultimately, it becomes a well-defined trading model. It’s akin to crafting a scientific theory: you observe, hypothesize, test, and finally, conclude.

Firstly, you need to identify your trading style. Are you a day trader, a swing trader, or perhaps a long-term investor? Each style has its own pace and risk appetite, influencing your model structure. Subsequently, selecting appropriate trading indicators comes into play. These might include moving averages, relative strength index (RSI), or Bollinger bands, to name a few.

Moreover, determining risk parameters is crucial in the process of building your trading model. Risk parameters help control potential losses, which is as vital as striving for profits. From there, you’ll formulate your trading rules and strategies based on your indicators and risk tolerance.

Testing a Trading Model

It’s not enough to build a trading model. Testing it is a fundamental part of the process. It’s a methodical way to validate the viability of your model before you stake real money. Not only does testing provide reassurance, but it also aids in fine-tuning your strategy.

Backtesting is one commonly used testing method. It involves applying your trading model to historical data to see how it would have performed. Meanwhile, forward testing, also known as paper trading, lets you test your model using current, live data without risking actual capital. Both methods have their advantages and should be employed for a comprehensive review.

Let’s remember, building and testing profitable trading models are not one-time activities. It’s an ongoing process, adapting and evolving with market trends. In the end, it’s not just about finding profitability, but also about improving your trading knowledge and sharpening your decision-making skills. Embrace the journey, and remember to always strive for progress, not perfection.

What is a Trading System?

In the world of finance, understanding the concept of a trading system is vital. Essentially, a trading system is a set of rules and procedures to guide when to buy or sell a security. These rules, based on pricing, timing, quantity, or a mathematical model, streamline the trading process and help reduce emotional and irrational responses.

The Value of a Well-Structured Trading System

Building a well-structured trading system is akin to constructing a sturdy ship for an arduous sea voyage. Without it, your journey through the volatile waters of the market can be chaotic and aimless. For a successful trader, a systematic approach is key. It sets the framework for decision-making, risk management, and ultimately, profitability.

Moreover, a sound trading system reduces stress. With clear guidelines to follow, you’re less likely to second-guess your actions. Consequently, this can improve your efficiency and confidence, driving you to execute trades promptly and decisively.

Trading Systems and Profitability

A well-built trading system is a powerful tool for achieving trading profitability. By systematizing your actions, you can sidestep common pitfalls like over-trading, knee-jerk reactions to market news, or chasing losses. Thus, the process of building and testing profitable trading models becomes more manageable and less stressful.

Importantly, your trading system’s rules should match your trading goals and risk tolerance. Additionally, regular reviews and adjustments are crucial to ensure it remains effective in various market conditions. Remember, a static system in a dynamic market can spell disaster.

In conclusion, the role of a trading system in successful trading can’t be overstated. It’s the bedrock on which you build your trading strategies and the compass that guides your trading decisions. Hence, investing time and effort in building and testing profitable trading models should be a priority for every trader aiming for long-term success.

Building a Profitable Trading Model

Constructing a profitable trading model is akin to solving a complex puzzle. The pieces include market observations, trading indicators, risk parameters, and trading rules. Each piece alone is meaningless. But when put together, they form a profitable and coherent picture.

What is a Trading Model?

At its core, a trading model is a set of rules and guidelines that dictate when to buy, sell, or hold a financial instrument. Like a recipe for your favorite dish, it combines different ingredients in the right proportions to achieve desired results. The focus lies on analysis and strategy, not on hunches or intuition.

Steps to Build a Profitable Trading Model

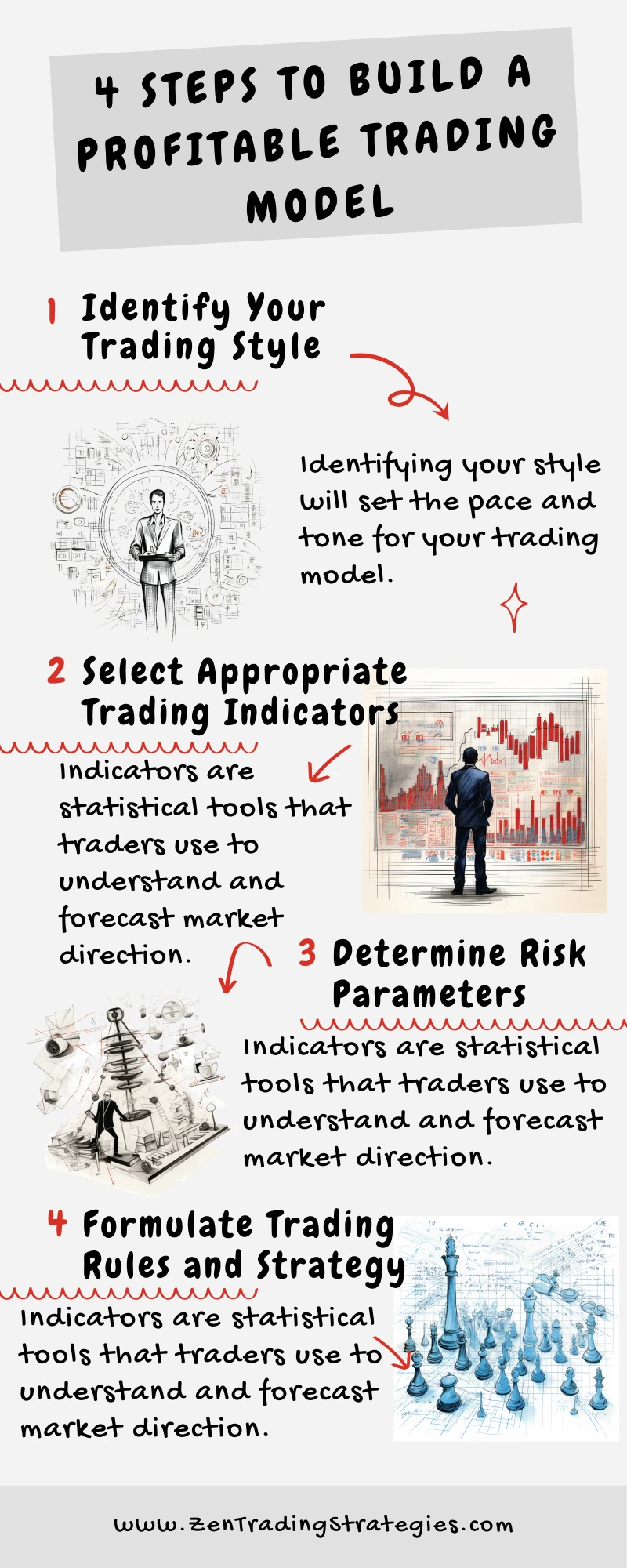

1. Identify Your Trading Style

Firstly, you must identify your trading style. Are you a day trader, focusing on short-term price movements? Or do you favor swing or position trading, targeting larger price moves over longer periods? Identifying your style will set the pace and tone for your trading model.

2. Select Appropriate Trading Indicators

Next, choosing the right trading indicators is crucial. Indicators are statistical tools that traders use to understand and forecast market direction. Moving averages, stochastic oscillators, or MACD might form part of your trading model, depending on your strategy and style.

3. Determine Risk Parameters

Risk management is a critical aspect of trading. Hence, defining your risk parameters forms an integral part of building your trading model. These parameters should define the maximum loss you’re willing to accept on individual trades and overall portfolio.

4. Formulate Trading Rules and Strategy

Lastly, you’ll need to formulate your trading rules and strategy. This stage requires integrating your chosen indicators with your risk parameters to create a systematic decision-making process.

A Case Study: Building and Testing a Successful Trading Model

Consider the case of Jane, a hypothetical swing trader. Jane focused on a single indicator: the Moving Average Convergence Divergence (MACD). She used it to identify potential buy and sell signals in the forex market.

Jane set her risk parameters not to lose more than 2% of her trading capital on any single trade. By defining her trading rules based on the MACD crossover and divergence, Jane knew when to enter or exit a trade.

Jane’s story highlights the importance of building and testing profitable trading models. It shows how a systematic approach can help traders navigate the volatile markets confidently.

The Importance of Building and Testing Profitable Trading Models

Building a trading model is a significant first step. However, testing it in various market conditions is what truly determines its profitability. Through building and testing profitable trading models, traders can validate their strategies before risking real money.

Ultimately, constructing a trading model requires careful planning, selection of indicators, risk management, and formulation of trading rules. Through a systematic and consistent approach, traders can increase their chances of success in the market. After all, in the world of trading, it’s not just about the destination but also the journey.

Testing a Trading Model

After constructing a trading model, the real work begins. The focus shifts to testing the model’s efficiency and profitability. This phase is crucial because it allows us to test our strategy against real market conditions without risking actual capital. In short, testing a trading model is an essential part of the journey towards building and testing profitable trading models.

Backtesting: Checking Past Performance

Backtesting involves running your trading model against historical market data. By doing so, you get an idea of how your model would have performed if it had been used during that period. While backtesting doesn’t guarantee future performance, it’s a valuable tool for understanding a model’s potential.

Forward Testing: Simulating Real-Time Trading

On the other hand, forward testing, or paper trading, involves testing the trading model in real time, but with virtual money. This method provides a more realistic simulation of market conditions, helping you assess your model’s effectiveness before deploying actual capital.

Walk Forward Analysis: The Best of Both Worlds

Walk forward analysis takes the benefits of both backtesting and forward testing and combines them. It optimizes the model with historical data (backtesting), then verifies the performance with out-of-sample data (forward testing). This iterative process provides a robust and reliable evaluation of the trading model.

Avoiding Overfitting During Testing

An important aspect of testing a trading model is to avoid overfitting. Overfitting happens when a model performs well on historical data but poorly on new or unseen data. To avoid overfitting, use out-of-sample data for testing and keep the model as simple as possible. Remember, a good model is one that performs well consistently, not just on specific data sets.

Testing a Successful Trading Model: An Example

Consider John, a hypothetical trader who built a trading model based on momentum indicators. After building his model, he backtested it on five years of historical data to ascertain its performance. Satisfied with the results, he then forward tested the model for three months in real-time market conditions, using virtual money. Happy with the model’s consistent performance, John was confident to start using it for live trading.

This example emphasizes the importance of rigorous testing in the process of building and testing profitable trading models. Without adequate testing, you risk making trading decisions based on potentially flawed assumptions, which could lead to significant losses.

In conclusion, creating a trading model is only half the battle. The other half is a rigorous testing process, ensuring that the model can withstand varying market conditions and deliver consistent results. Remember, building and testing profitable trading models is a process of continuous learning and improvement. So, always remain open to tweaking your models as you learn more about market behaviors and trends.

Use of Technology in Building and Testing Profitable Trading Models

The age of technology has ushered in new ways of building and testing profitable trading models. Today’s traders have a variety of software and algorithms at their disposal to make the process more efficient and accurate.

The Role of Trading Software and Algorithms

In our digital era, technology has an enormous role in trading systems. Trading software and algorithms help automate the process, reduce human error, and speed up analysis. They can analyze vast amounts of data in seconds, allowing for more precise predictions and faster decision-making.

Moreover, these tools enable traders to backtest and forward test their models with ease. The software automates the process, crunching years of data in moments to reveal how a model would have performed in the past.

Automating and Improving Model Testing: A Case Study

Consider MetaTrader, a popular platform among forex traders. Its built-in language, MQL4, allows traders to create and test their custom trading models. Similarly, TradeStation provides EasyLanguage, a user-friendly coding language that lets traders design and backtest their trading models.

Such platforms revolutionize the process of building and testing profitable trading models. They allow traders to focus on refining their strategies, as the software takes care of the heavy lifting.

Risks and Considerations when Using Technology

While technology has made trading more accessible and efficient, it’s not without risks. Over-reliance on software and algorithms can lead to overlooking market subtleties that a computer can’t grasp. After all, trading involves human psychology, something that an algorithm can’t fully understand.

Furthermore, a technical glitch or faulty code could wreak havoc on a trader’s account. Therefore, it’s crucial to balance technology use with personal knowledge and oversight. Testing all software thoroughly before use is also a must.

In conclusion, technology is an invaluable tool in modern trading. It simplifies and accelerates the process of building and testing profitable trading models. However, a good trader understands its limitations and uses it as a tool, not a crutch. After all, successful trading is as much about human judgment as it is about accurate algorithms.

Conclusion: Reflecting on Building and Testing Profitable Trading Models

As we conclude our journey, it’s clear how critical the process of building and testing profitable trading models is to successful trading. By creating robust, well-tested models, traders can navigate the complexities of the financial markets with greater confidence and precision.

Throughout this exploration, we’ve understood that a trading model isn’t simply a set of rigid rules. Instead, it’s a dynamic, evolving tool that should be continuously refined to match changing market conditions. This constant learning and adaptation process can lead to continuous improvement in your trading performance.

One key take-away from our discussion is the balance between human judgement and technology. While trading software and algorithms have greatly simplified the process of building and testing models, they should complement, not replace, human insight. Traders must remain engaged and attentive, ensuring their understanding of market trends and dynamics.

Building and testing profitable trading models isn’t just about the literal act of constructing and verifying a model. It represents an ongoing commitment to learning, adapting, and striving for success in the dynamic world of trading. Whether you’re a beginner or an experienced trader, embracing this philosophy can help you reach your trading goals and beyond.

Stay curious, keep learning, and never stop refining your trading system. That’s the true essence of building and testing profitable trading models. The market awaits your next move.

Your Next Steps: Building and Testing Profitable Trading Models

The world of trading system development awaits you! It’s time to embark on the rewarding journey of building and testing profitable trading models. By applying the insights shared in this guide, you can take significant strides towards achieving trading success.

Embrace the Learning Journey

To further your learning, consider enrolling in online courses, or reading seminal books on trading. Leveraging these resources can significantly enhance your understanding of the trading landscape and equip you with the knowledge needed to create powerful trading models.

Stay Connected and Share Your Journey

Trading is a journey best shared, so feel free to spread the word among your network. Your friends interested in trading system development might thank you later!

At the end of the day, remember that the process of building and testing profitable trading models is just as important as the end result. It’s a cycle of learning, applying, testing, and refining. So go ahead, dive into the world of trading models, and let the markets be your classroom. Your trading adventure starts now!